Two weeks ago, the Trump administration presented a detailed version of one of Trump’s most important election promises: a tax reform. What are the consequences of Trump’s recent tax proposal for the US budget deficit and public debt?

Click here to continue readingAs long as the stock market is booming, businesses get away with shady accounting practices. What do the recent cases of Netflix, Tesla and Alphabet suggest about what phase of the business cycle we are in?

Click here to continue readingThe US economy is growing at a 3% annual rate. But are things as they seem?

Click here to continue readingOne of the most interesting discussions in the field of monetary theory concerns the role central banks play in the economy. There are multiple views regarding different issues: from questioning the mere existence of the central bank to the actual role a central bank should take.

Click here to continue readingLast year, non-financial companies issued $674.3 billion in corporate debt, a new record high. Low interest rates are wrecking the allocation of capital: the increase in debt is not used to invest, but rather to distribute cash to shareholders. However, there is one important caveat to this whole scheme that will threaten the U.S. economy.

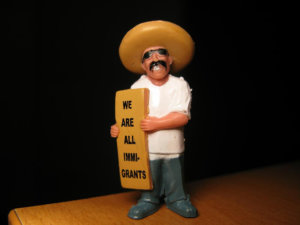

Click here to continue readingWith the persistence of the new president of the United States to build a wall and his expectation to make Mexicans assume the cost, new creative initiatives to find a way to make them pay it are starting to emerge.

Click here to continue readingThe annualized quarterly GDP is growing, but it has been growing at a lower rate since the third quarter of 2015. Commercial and industrial credit is growing at a rate of an economy that is not expanding.

Click here to continue readingDuring the last seven years credit volumes did not grow as as in previous liquidity periods, despite having the federal reserve interest rates close to 0%. This means the US economy is not expanding.

Click here to continue readingToday, the central bank debate focuses on whether they should continue to use the inflation target as the main objective for monetary policies or if it should change to a nominal GDP target.

Click here to continue readingWhen talking about economic recovery, a distinction must be made between short-term and long-term effects. We’ll label as short-term effects those that last less than a year, and as mid and long term those that last more than a year. In practice, three to five years are needed to determine if effects are long lasting or not.

Click here to continue readingGet our free exclusive report on our unique methodology to predict recessions